In Iowa, the abstract of title is a crucial part of all real estate sales. Before you sell your property, you need to have your abstract of title updated and checked for title defects.

To learn more about abstracts, and why you need yours when selling your home in Iowa, read on.

And what if you can’t find your abstract? We’ll give you suggestions on where to start looking.

What is an abstract of title?

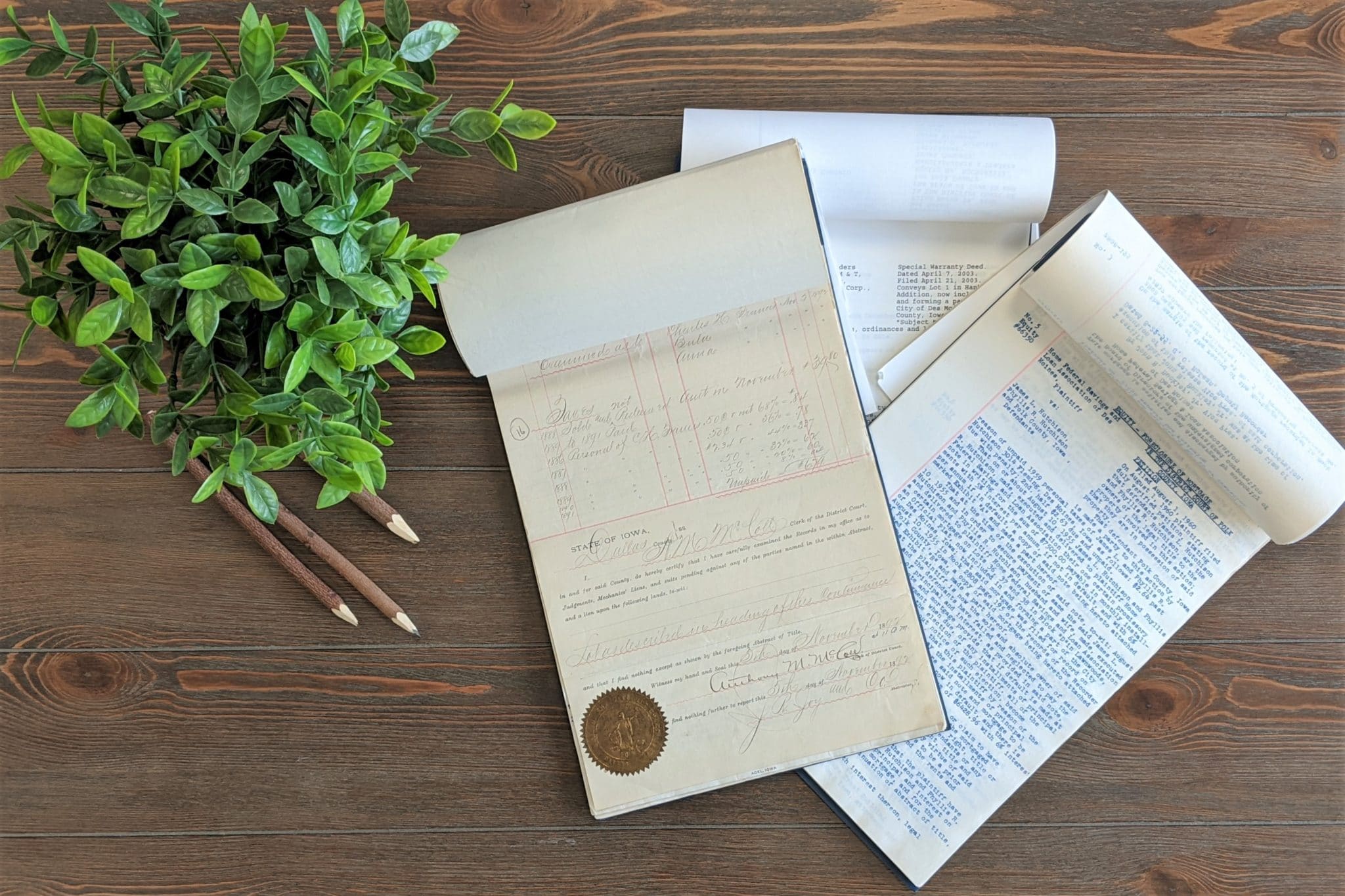

An abstract of title, also simply called an abstract, is a legal document stating the current and historical ownership of a piece of property. It’s a physical, chronological record of a property, based on public records.

When a property gets sold in Iowa, the ownership information on the abstract gets updated. Then it gets checked for title defects, or problems, with the title that could affect future owners.

Is the title different from the abstract?

The title is a legal document listing the current owner of a property. Iowa uses abstracts, and the abstract contains the history of ownership and other property information.

What information is in a property abstract?

Abstracts are based on public records, so they contain any public documents relative to the property. Information in the abstract of title can include:

- Owner information

- Deeds

- Plat map of the property

- Easements (land that gets used by a non-owner, such as utilities)

- Survey information (determines property boundaries)

- Covenants and restrictions (Homeowner’s Association [HOA] or subdivision rules and regulations)

- Liens (unpaid debt attached to the property)

- Unreleased mortgages

- Wills, litigation, and tax sales

- Special assessments (property tax or HOA assessments)

Why is the abstract so important when selling your home in Iowa?

As soon as you accept an offer from someone to buy your property, work on the abstract needs to begin.

First, the abstract gets sent to an abstract company or attorney to have it updated. This process can take up to a week.

Once the abstract is brought up to date, an attorney performs a title opinion. The title opinion is a review of the abstract to determine if the property has a marketable or clear title.

What’s the point of a title opinion?

The title opinion shows any title defects. It’s a way to help protect the buyer of the property from future financial or ownership problems.

Title defects could be outstanding liens, judgments, flawed legal descriptions, or other issues that could impact the property’s future owner(s).

Buyers don’t want to find out a year after they buy the property that the seller’s estranged ex-spouse has a claim on the property, for example. They want reassurance that the property will not carry forward any problems when they take ownership.

If no title defects get discovered in the title opinion process, the title is considered cleared.

If title defects are found, the seller will have to take action needed to clear the title before closing.

What does it mean to “clear” a title?

Clearing the title means the seller fixes any title defects found in the title opinion. It could be as simple as correcting a misspelling. But it could also mean the seller needs to pay off a lien or get a mortgage released.

Why is Iowa an abstract state?

All states update ownership and do a title search for real estate transactions. And most states require private title insurance to protect the buyer against title defects.

But Iowa prohibits the sale of private title insurance.* Instead, Iowa uses the abstract and title opinion to ensure a buyer gets a clear title before closing.

In Iowa, once the abstract is updated and the title cleared, buyers get protection through the Iowa Finance Authority, a state agency. Title insurance is issued by Iowa Title Guaranty, protecting buyers from the financial fallout of any title defects.

At face value, Iowa’s process can seem complicated, but it’s more straightforward and cheaper than many other states. In Iowa, there are no costly insurance agent commissions or competition amongst insurers. And the state’s system often provides better protection for the buyer of the property.

*Why doesn’t Iowa allow the sale of private title insurance? The bankruptcy of insurance companies in the 1930s resulted in their inability to protect home buyers from title defects. The companies’ failure to safeguard buyers resulted in severe financial consequences for some property owners.

How to find your abstract

When you own a property, the abstract of title belongs to you. It’s essential to keep track of the abstract for when you sell the property. If you can’t find your abstract, it can be replaced, but replacement can be costly.

What does an abstract look like? Abstracts contain many pages of documents that are bound together. They can include years and years of paperwork, depending on the age of the property. So the older the property, the more pages the abstract will have.

Where abstracts are kept

If you aren’t sure where your abstract is, it pays to take the time to try to track it down. First, look in your home and then start checking with businesses, like your mortgage company and attorney’s office.

When property owners store their abstract, it’s usually in a secure place, such as a home fire safe or a safe deposit box at a bank.

Also, mortgage companies, title companies, and attorneys’ offices store abstracts for their customers. Typically, businesses provide a receipt to the customer when they store it.

If you don’t know where your abstract is, think back to when you bought your home and try to track down the paperwork from your closing. Find businesses that handled the mortgage, title, and legal paperwork. If you didn’t keep the abstract, one of those companies could have it in storage. Start calling the companies and ask if they have it.

Places to look for your abstract:

- Fire-safe

- Filing cabinet

- Safe-deposit box

- Mortgage company

- Attorney’s office

- Title company

If you can’t locate your abstract, you might have to have a professional abstractor recreate it.

We’re not lawyers so we cannot provide legal advice, but we can buy houses! So if you need to sell your home fast? No matter the property condition, we can help you find a solution that works for you. Our team of professional, experienced, and genuine individuals is here to help.