What Should I Do if My Home is in Pre-Foreclosure in Des Moines?

Falling behind on your mortgage is a stressful situation that no one wants to be in. It can happen if you lose your job, become very sick or get divorced. Or because of many other catastrophic situations.

If you haven’t paid your mortgage for three or more months, your lender can start the repossession process with pre-foreclosure. You might be wondering, what does pre-foreclosure mean?

It’s a warning that you should take seriously, because it means you could eventually lose your home if you don’t pay your bill or adjust your loan. What is a loan commitment? Find out here. After a period of anywhere from 3–10 months, your home will be auctioned. And you will be homeless.

Foreclosure won’t happen immediately, but it’s important to do everything you can to avoid losing your home.

Coronavirus and Mortgage Relief Under the CARES Act

Currently, the CARES Act provides some foreclosure protection and relief for Iowans through at least December 31, 2020. This applies to federally or government-sponsored enterprise mortgages, such as FHA, VA, USDA, Fannie Mae and Freddie Mac.

It also applies to conventional mortgages, if they’re backed by the federal government. Conventional is the most common type, as they account for 64% of mortgages. If you don’t know what kind of mortgage you have, check with your loan servicer.

Here are some of the provisions of the CARES Act for mortgages:

- Lenders are prohibited from foreclosure on you until at least December 31, 2020. This includes beginning procedures or finalizing of a foreclosure judgment.

- You can request a 180-day forbearance from mortgage payments, if you’re experiencing coronavirus-related financial hardship. You can also request another 180-day extension. To do this, contact your loan servicer. There won’t be any fees, penalties or additional interest, but you’ll still owe the money eventually. Forbearance doesn’t erase or forgive payments. It just temporarily postpones or reduces them, so make sure to ask your servicer how forbearance will be repaid. In most cases, you’ll do it over time.

The Consumer Financial Protection Bureau can help you determine what kind of relief you might qualify for and walks you through how to request coronavirus-related mortgage relief. And what to do when you receive mortgage forbearance.

There are a few more things you can do in the meantime, as the CARES Act is currently only temporary. Here is what to do if you’re in pre-foreclosure.

Take Immediate Action to Avoid Foreclosure

The most ideal step to solve pre-foreclosure is to pay what you owe, but many times that isn’t possible. That’s why the U.S. Department of Housing and Urban Development has put together a list that can help you avoid foreclosure.

Don’t Ignore the Problem

If you can’t make your mortgage payment, don’t ignore the problem and fall further behind. Contact your lender right away to take advantage of programs that can help you in hard times. One of these programs is loan modification, which extends your loan but gives you more affordable payments.

Cut Your Spending

You should also take a close look at your budget. Is there any unnecessary spending or monthly memberships that you can eliminate? HUD recommends delaying payments on credit cards until your mortgage is taken care of.

Can you sell a car or another expensive belonging? What about getting a second job? HUD says this initiative shows your lender you’re serious about keeping your home.

Other Options to Avoid Foreclosure in Des Moines

There are two other options you can take to get out of foreclosure, but both require you to give up your home.

You can sell your home through a short sale, where you will sell your home for the amount left on your loan. Or you can get a deed in lieu of foreclosure, where you will give your lender your home in exchange for your mortgage being forgiven. While it won’t cause a major impact on your credit score, getting this deed should be considered your last option.

Contact a Pre-Foreclosure Counseling Agency and Ask for Help

HUD recommends contacting an approved counseling agency. While it might be embarrassing, don’t be afraid to ask for help. The state of Iowa and the federal government offer several resources to hardworking Iowans like you who have fallen behind on their mortgages.

Iowa Mortgage Help is a state-sponsored safe and free mortgage counseling resource. Their counselors help people who are behind on their mortgage payments or are close to financial trouble.

Your local federal housing counseling agency can also offer guidance on foreclosure prevention. If you are a veteran, the Veterans Affairs Regional Loan Center helps with delinquent mortgage loans.

If you’ve talked with a counselor and your lender, but you aren’t getting anywhere, HUD may be able to help with FHA, VA and conventional mortgages.

Take Advantage of Federal Foreclosure Programs

There are many other federal foreclosure programs that can help, such as:

- Lowering your monthly payment and interest rate to help you avoid foreclosure.

- Refinancing for underwater mortgages, which is when you owe more than your house is worth.

- Temporary reduction or suspension of mortgage payments during unemployment.

- Managed exit to transition to more affordable housing or reclaiming your foreclosed home.

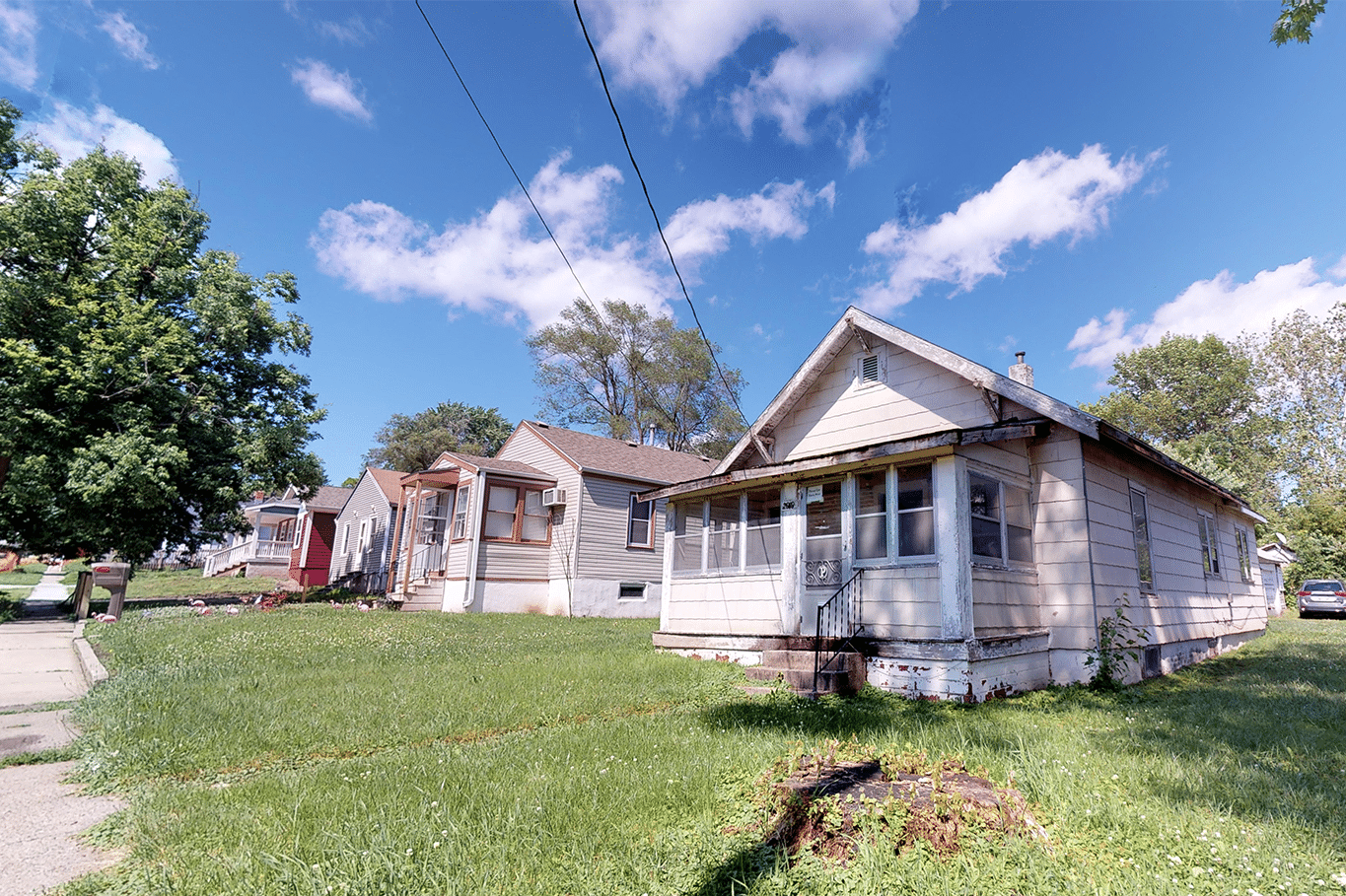

Contact Sell Now Iowa

If you’re in a tough spot, Sell Now Iowa may be able to help. Our real estate professionals buy houses for cash in Des Moines and guarantee closing on every offer we make.

Our team starts with a free consultation, where we’ll learn about your situation and your property. Then, you’ll receive a no-obligation cash offer with zero contingencies within 24 hours. We do our closings in-house, so you can sell your property fast and get on with your life.

When you need to sell your house fast, give us a call at 515-531-2274 today.